Retirement Max 2024. Morgan professional to begin planning your 2024. Here's what maxing out an ira could do for you.

The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older. The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2024 tax year.

The Ira Contribution Limits For 2023 Are $6,500 For Those Under Age 50 And $7,500 For Those 50 And Older.

401(k) pretax limit increases to $23,000 the dollar limitations for retirement plans and certain other dollar limitations that.

Meanwile, The Contribution Limit For Simple Iras In 2024 Is $16,000 Or $19,500 If You’re 50 Or Older.

In 2024, income limits are $76,500 for married couples filing jointly in 2024, up from $73,000 in 2023.

401(K), 403(B) And 457 Elective Deferral Limit $23,000.

Images References :

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, The elective deferral limit for simple plans is 100% of compensation or $16,000 in 2024, $15,500 in 2023, $14,000 in 2022, and $13,500 in 2020 and 2021. For heads of household, the 2024 is $57,375, up from.

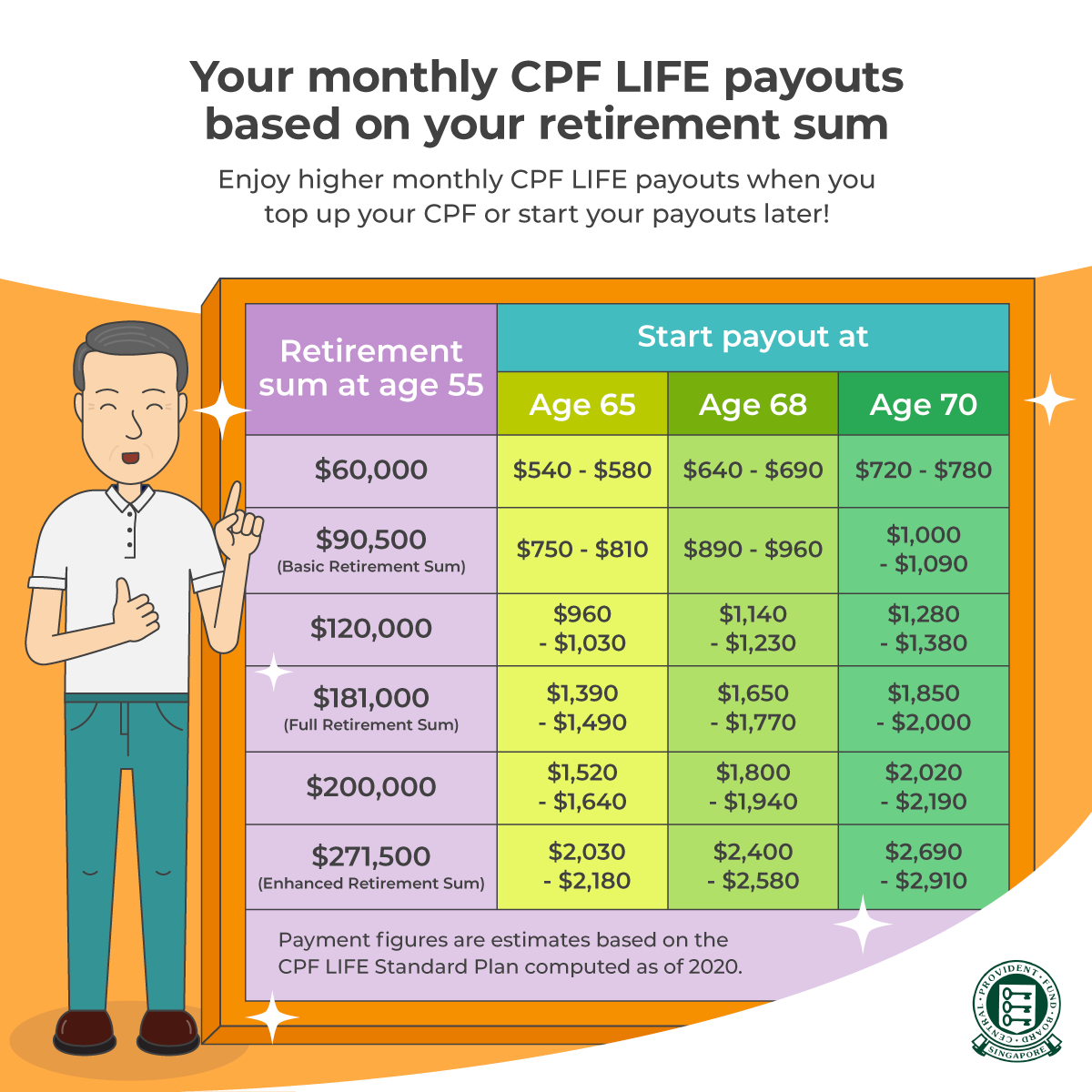

Source: yourwealthdojo.com

Source: yourwealthdojo.com

5 Things You Need To Know About Your CPF Wealthdojo, The effective date of the 2024 retirement plan limits. Iras have lower contribution limits than a 401 (k).

Source: hoagsomematim.blogspot.com

Source: hoagsomematim.blogspot.com

at what age do you have to take minimum distribution from a 401k Hoag, That cap is up from $66,000 in 2023. Get a quick summary of the 2024 retirement contribution plan limits for plans like 401 (k)s, 403 (b)s, 457 (b)s, iras, and more.

Source: elinorewglad.pages.dev

Source: elinorewglad.pages.dev

2024 Roth Limit Rory Walliw, The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. And for 2024, the roth ira contribution limit is $7,000.

Source: www.pinterest.com

Source: www.pinterest.com

Are you on track? This is how much it costs to retire comfortably in, In 2024, income limits are $76,500 for married couples filing jointly in 2024, up from $73,000 in 2023. What’s changing for retirement in 2024?

Source: sandboxfp.com

Source: sandboxfp.com

Retirement Strategy Planning Your Retirement Lifestyle — Sandbox, For 2023, you can contribute a. The lesser of the maximum dollar limitation for annual benefits under defined benefit plans under internal revenue code (irc) section 415.

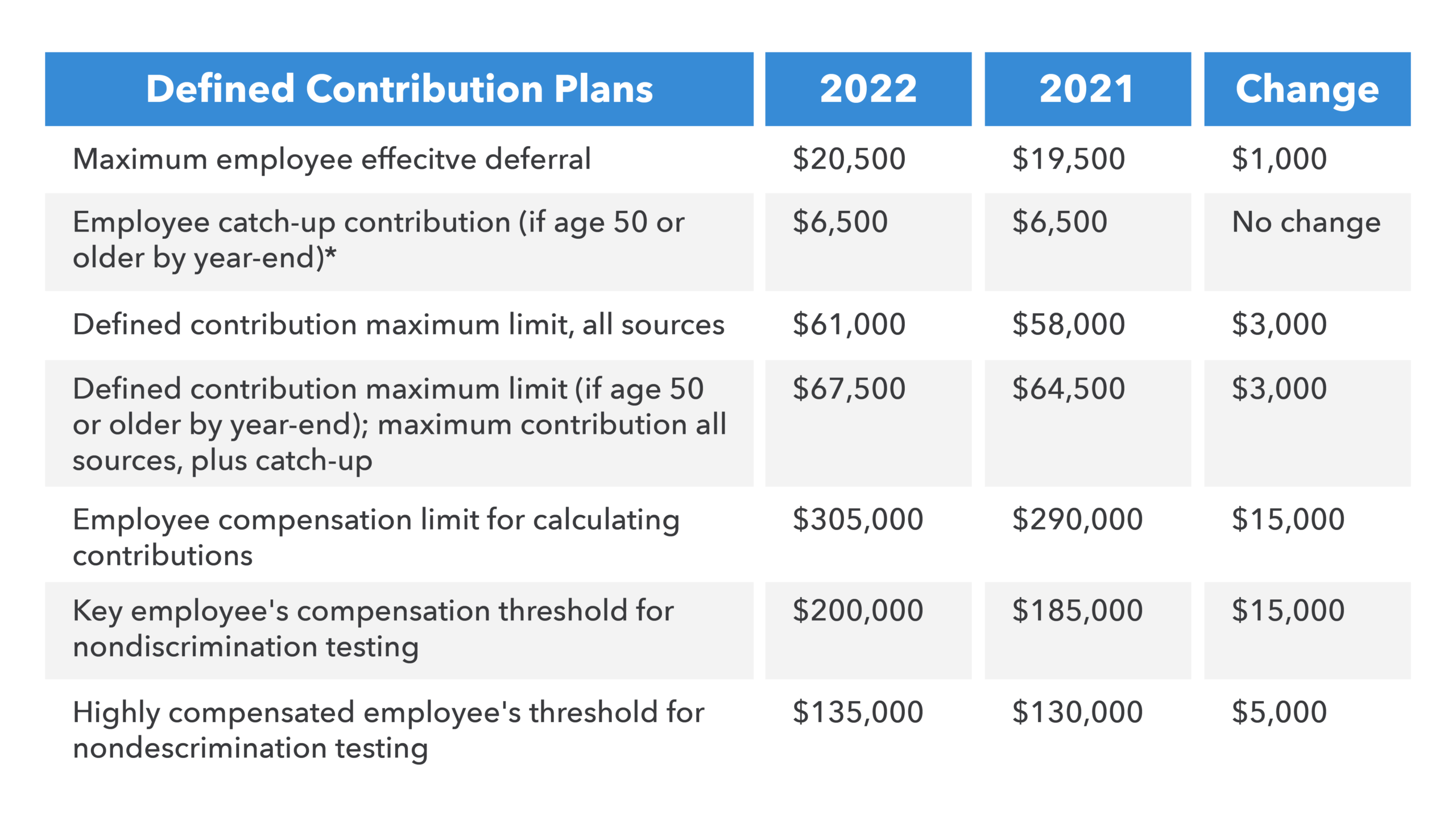

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

2024 Defined Contribution Limits Cammy Caressa, The elective deferral limit for simple plans is 100% of compensation or $16,000 in 2024, $15,500 in 2023, $14,000 in 2022, and $13,500 in 2020 and 2021. The lesser of the maximum dollar limitation for annual benefits under defined benefit plans under internal revenue code (irc) section 415.

Source: bahamas.desertcart.com

Source: bahamas.desertcart.com

Buy Happy Retirement Banner Sign for Retirement Office Farewell Party, The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older. In 2024, income limits are $76,500 for married couples filing jointly in 2024, up from $73,000 in 2023.

Source: mungfali.com

Source: mungfali.com

2024 PNG, 401(k), 403(b) and 457 elective deferral limit $23,000. Meanwile, the contribution limit for simple iras in 2024 is $16,000 or $19,500 if you’re 50 or older.

Source: oec.z35.web.core.windows.net

Source: oec.z35.web.core.windows.net

Golden Age Investments Gold IRA Rollovers for a Secure Retirement, The limit increases to $57,375 for heads of household in 2024, up from. 401(k) pretax limit increases to $23,000 the dollar limitations for retirement plans and certain other dollar limitations that.

The Ira Contribution Limits For 2023 Are $6,500 For Those Under Age 50 And $7,500 For Those 50 And Older.

The irs released the retirement contribution limits for 2024 1 and we are breaking it down for you.

The Limit Increases To $57,375 For Heads Of Household In 2024, Up From.

For 2024, the ira contribution limits are $7,000 for.